How can technology support against financial crimes in current context? - Anti Money Laundering

AUTHORED BY Tharanga Karunatilake, BUSINESS CONSULTANT FOR Banking Systems AT N-ABLE

“Dirty money has no place in our economy, whether it comes from drug deals, the illegal guns trade or trafficking in human beings. We must make sure that organized crime cannot launder its funds through the banking system or the gambling sector. Our banks should never function as laundromats for mafia money or enable the funding of terrorists.”

Cecilia Malmström, EU Home Affairs Commissioner, speaking about the Fourth EU Money Laundering Directive on 6 February 2013

What is Anti-Money Laundering (AML)?

Anti-money laundering (AML) refers to the laws, regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income.

Anti-Money Laundering (AML) helps to prevent criminals’ financial crimes and illegal activities by its policies, laws, and regulations. Companies must comply to these policies, laws, and regulations even though the compliance is complex.

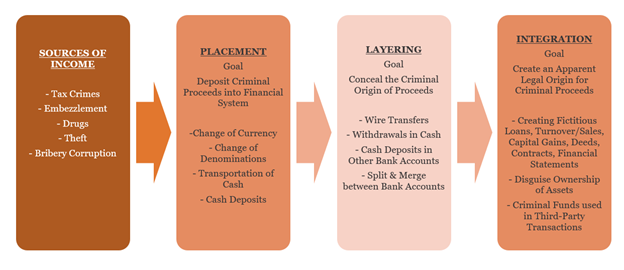

Process of AML

Money laundering is the process of “cleaning” the proceeds of criminal activity, such as drug trading or human smuggling appear to have come from legitimate sources.

- Placement: Black money enters the financial system. Typically, this is someone’s bank account – personal or business.

- Layering: Also called laundering, this stage essentially moves the money about. It’s often transferred to offshore companies or bounced from one shell company to another. The end goal is to hide its origin.

- Integration: This is the final stage when the money is used to purchase assets. Most common assets purchased with previously dirty money include property, fine art, and commercial investments.

Why AML is important?

AML operators do act as gatekeepers against general fraudulent activities. A solid money laundering process will assist in blocking all types of crimes.

Money laundering will be used by criminals to hide their crimes and to use their dirty money more effectively. Financial crimes will be boosted if financial institutions do not comply with the regulations. Therefore, financial institutions play a major and a critical role in fighting against financial crimes.

How does AML system process happen in a bank?

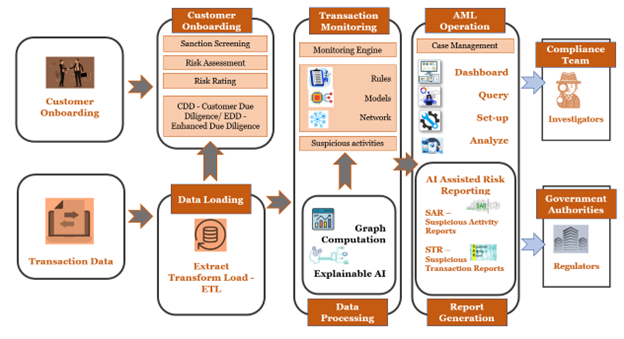

AML will be screened via

- Customer onboarding

- Transactions

Monitoring will be happened using,

- Lists (Watch List, Political Exposed Persons List)

- Link Analysis (Transactions & Relationships)

AML system helps to fulfil various needs in the AML compliance management lifecycle, from listing, screening, analysis, and assessment to regulatory reporting. The system needs expert experience with new technologies such as data processing, artificial intelligence (AI), graph computing, optical character recognition (OCR) and privacy-preserving technologies along with expert knowledge to build a digital, innovative, and intelligent risk-based AML system that is truly capable of meeting the challenges of our time.

Why is AML important to the Banking Industry?

Banks are the largest institutions in the market that facilitate millions of transactions throughout the day. These institutions are carrying a major risk of financial crimes. Criminal organizations often carry out their money laundering activities through these financial institutions. The AML process has been identified as a critical process in financial and reputational banks. Auditors and regulators recommend that this process as legally required process. Therefore, bank must identify risks by fulfilling the AML obligations and taking necessary precautions.

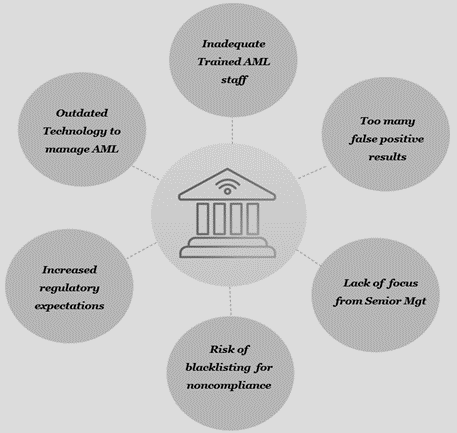

Biggest AML compliance challenges faced by banks currently:

How do AML policies affect Banks?

Even though, banks and other financial institutions are legally forced to follow AML regulations, they believe that implementing policies is costly, time consuming, ineffective. However, the cost that must bear after a reputation damage is more costly than implementing an AML solution to banks or other financial institution.

In recent years audits have made organizations to follow regulations and organizations who did not comply had to pay heavy penalties. Apart from these penalties, financial institutions that do not meet AML compliance can damage the reputation and will start to lose customers since financial institutions associate with fraudulent individuals and businesses mainly.

How N-able helps financial institutions to improve their AML process?

Anti-Money Laundering software helps organizations control their customers faster and safer.

N-able supports banks in a global scale and ensures to adhere strictly to most comprehensive regulations including initial verifications, watchlist screening, transaction monitoring and case management. Our AML solutions help banks to speed up real time onboarding while identifying risks faster and more accurately by meeting strict AML requirements and screening regulatory obligations.

N-able is consisted with well-trained employees with more than 15+ banking experienced employees who have a clear and overall understanding of the banking environment. Also, it has been proved that with the developments and the implementation support we have given for the top-level banks in Sri Lanka.