How Banks can implement chatbots to provide 24/7 customer service

Authored by Inuka Rathnayake

Customer Service in a Digitalized World

In today's fast-paced, digitalized world, customers expect immediate and seamless access to support and information from their banks. To meet these expectations, many banks are turning to chatbots as a way to improve their customer service offerings.

In this article, I will discuss how banks can implement chatbots to provide better customer service to their customers. The thoughts I share are inspired firstly by my experience as a customer, and secondly based on the research done for my Masters in Computer Science focusing on Natural Language Processing (NLP) and Artificial Intelligence for consumer interactions.

What are Chatbots?

Chatbots are computer programs that use artificial intelligence (AI) and natural language processing (NLP) to simulate human conversation and provide customer support. These programs are designed to understand and respond to customer requests in a human-like manner, providing quick and efficient service.

Nearly 90% of bank interactions are automated through AI chatbots in 2022 - Juniper Research

Why Use Chatbots for Customer Service?

There are several reasons why banks should consider using chatbots. According to a recent article by Forbes, "The pandemic of 2020 may have been bad for a lot of businesses, but it was certainly good to technology vendors providing chatbots—i.e., conversational AI (artificial intelligence)—to banks", which will undoubtedly make the "the role of AI chatbots in the banking system in the coming years will be more significant and ever-expanding."

The need for contactless communication and services via digital platforms, in the post-pandemic world led to an increase in the interest in chatbots, paving the way for the emergence of conversational banking.

How will banks approach this transformational service model? While it will differ from bank to bank, I believe the following steps are key considerations in the implementations of the chatbots to enhance the customer experience (CX).

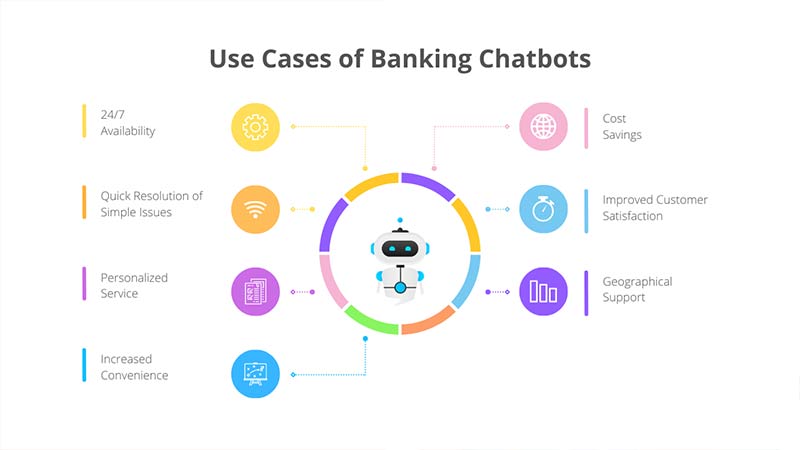

1. 24/7 Availability: Chatbots can provide customers with access to support and information around the clock, even outside of traditional business hours. This is especially beneficial for customers who prefer to do their banking outside of normal business hours or who are located in different time zones. Furthermore, this service will relieve some of the pressure coming towards to bank call center team.

2. Quick Resolution of Simple Issues: Chatbots can handle simple customer inquiries and requests quickly and efficiently, freeing up human customer service representatives to focus on more complex issues. This can help improve overall response times and reduce wait times for customers.

For example, I can list the following services which can be executed in full by using chatbots:

- Activating a new bank card.

- Report stolen or lost bank card.

- Activate/Unblock online banking portal user account.

- Bank balance check or Credit card interim statement.

3. Personalized Service: With the use of natural language processing (NLP) and machine learning, chatbots can provide a personalized experience for customers, tailoring responses based on their specific needs and preferences. This can help build trust and loyalty with customers, who are more likely to have positive experiences when they feel understood and valued.

4. Increased Convenience: Chatbots allow customers to access support and information through a variety of channels, including bank websites, mobile apps, and social media platforms, improving the overall convenience of customer service.

5. Cost Savings: Chatbots can significantly reduce the cost of customer service for banks, as they can handle a high volume of interactions simultaneously and reduce the need for human representatives.

6. Improved Customer Satisfaction: By providing quick and convenient support, chatbots can help improve overall customer satisfaction and build trust with bank customers.

7. Geographical Support: By consenting and providing access to device location tracking services, the user can ask questions like “Where is the nearest bank branch?” In this scenario, the chatbot will answer depending on the user’s location. In addition, Chatbots can track the location through device GPS or Wi-Fi location tracking also known as Wi-Fi Positioning System (WPS), thus providing accurate answers.

Chatbots can handle simple customer inquiries and requests quickly and efficiently, freeing up human customer service representatives to focus on more complex issues.

A Technological Perspective, How to Implement Chatbots for Customer Service

To get the most out of chatbots for customer service, banks could consider these following steps:

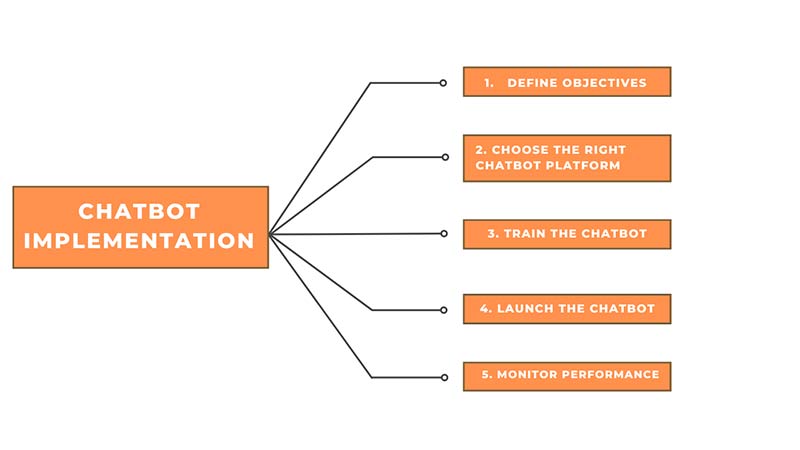

1. Define Objectives: Banks should determine the specific goals they hope to achieve through the use of chatbots, such as reducing wait times, improving response times, or providing 24/7 support.

2. Choose the Right Chatbot Platform: Banks should research and choose the chatbot platform that best fits their specific needs, taking into consideration factors such as integration with existing systems, ease of use, and cost.

3. Train the Chatbot: Banks should provide their chatbots with training data and fine-tune their algorithms to ensure they provide accurate and relevant responses to customer inquiries. You might wonder if a chatbot will support Unicode or Singlish, as many Sri Lankans use Sinhala as their primary language. I believe this can be done, with proper training done on the training model, where the chatbot can give outstanding results irrespective of the language.

4. Launch the Chatbot: Banks should launch their chatbots and monitor their performance closely, making changes and improvements as necessary.

5. Integrate with Human Customer Service Representatives: Chatbots should be used in conjunction with human customer service representatives, rather than replacing them, to provide a comprehensive and effective customer service experience.

Customer Benefits to Customer Service

In conclusion, chatbots can provide a range of benefits for banks looking to improve their customer service offerings. By providing 24/7 availability, quick resolution of simple issues, personalized service, increased convenience, cost savings, and improved customer satisfaction, chatbots can help banks enhance the customer experience and build trust and loyalty with their clients. By following the steps outlined above, banks can successfully implement chatbots for customer service and realize these benefits for themselves and their customers.